Tips for Applying A Personal Loan Online to Cover Unexpected Expenses

There are many benefits to taking out a personal loan. Perhaps you need to consolidate your debt, or maybe you need to make a major purchase. Whatever your reason, a personal loan can be a great option. A personal loan can give you some breathing room in your budget. If you have a tight monthly budget, a personal loan can help you cover unexpected expenses or give you some extra money to work with each month.

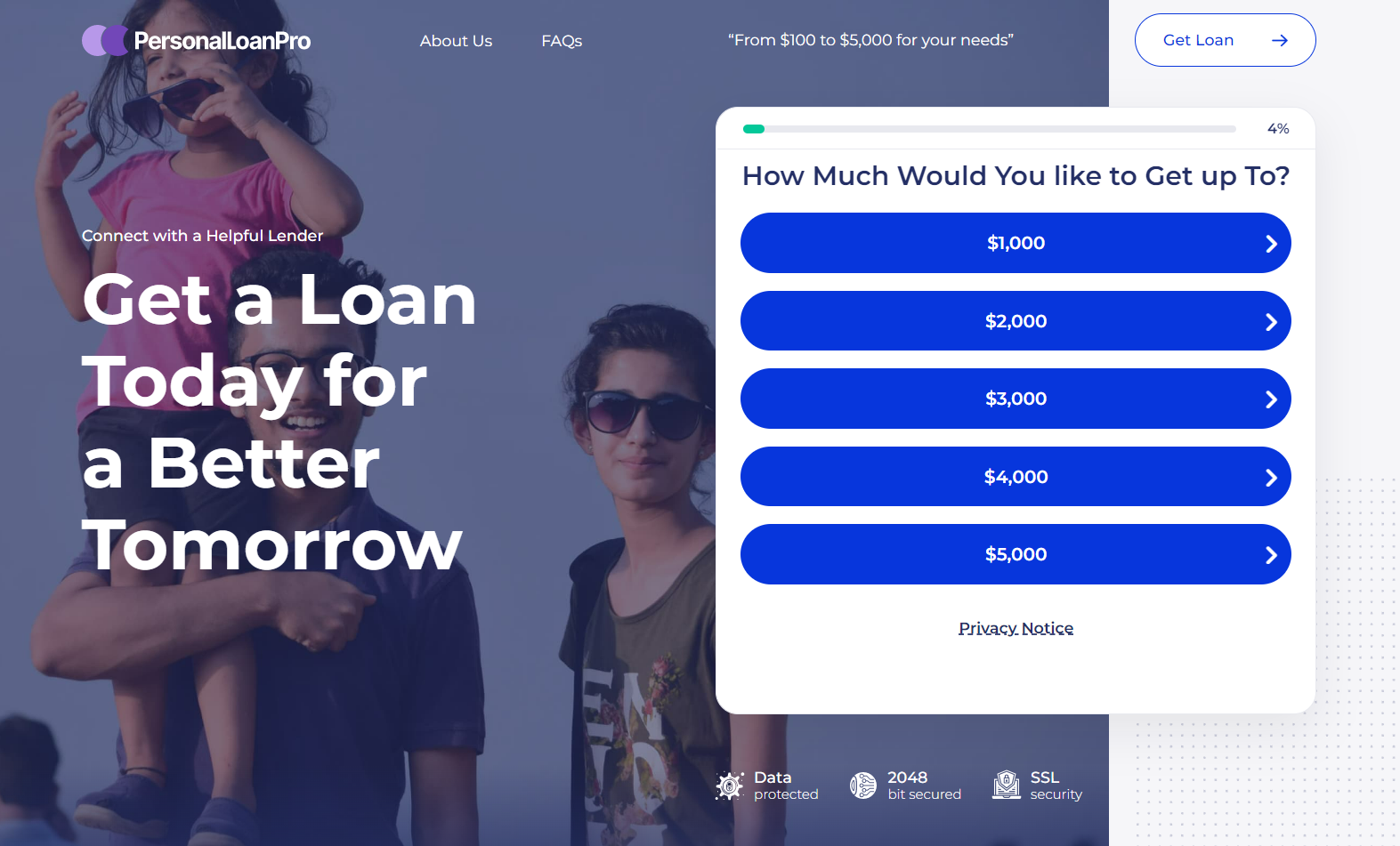

If you’re considering a personal loan, be sure to shop around and compare interest rates and fees from different lenders. And make sure you understand the terms of your loan before you sign on the dotted line. Here we would like to recommend Personal Loan Pro to borrowers who want to get a quick personal loan but worry about their credit score; click this link and get a personal loan from its site right now.

What Do We Need to Get A Personal Loan?

When it comes to personal loans, there are a few things you’ll need to have in order to get approved. Here’s what you need to know before you apply for a personal loan. The first is a good credit score. Lenders will use your credit score to determine whether or not you’re a good candidate for a loan. If you have a good credit score, you’re more likely to be approved.

The second thing you’ll need is a steady income. Lenders want to see that you have a regular income coming in, so they can feel confident that you’ll be able to make your loan payments on time. If you don’t have a regular income, you may still be able to get a personal loan, but you may have to provide some additional information to the lender.

The last thing you’ll need is collateral. Collateral is something that you can use to secure the loan. This can be something like your home or your car. If you don’t have any collateral to offer, you may still be able to get a personal loan, but the interest rate may be higher.

Now that you know what you need to get a personal loan, you can start shopping around for the best deal; check at Personal Loan Pro to get a personal loan with bad credit. Be sure to compare interest rates, fees, and terms before you choose a loan. And remember, always read the fine print!

What Are the Benefits of Personal Loans?

If you’re considering taking out a personal loan, you might be wondering what the benefits are. Here are some of the potential benefits of personal loans:

1. You can use the money for anything you want.

Personal loans can be used for just about anything – from consolidate debt to paying for a wedding. There are no restrictions on how you use the funds, so you can use them for whatever you need.

2. You may get a lower interest rate than with other types of loans.

Personal loans typically come with lower interest rates than other types of loans, such as credit cards or car loans. This means you’ll save money on interest over the life of the loan.

3. You may be able to get a fixed interest rate.

With a personal loan, you may be able to get a fixed interest rate. This means your payments will stay the same throughout the life of the loan, making it easier to budget for your monthly payments.

4. You may get a longer loan term.

Personal loans typically come with longer loan terms than other types of loans. This means you’ll have more time to pay back the loan, and you’ll have lower monthly payments.

5. There’s no collateral required.

Unlike some other loans, personal loans don’t require collateral. This means you don’t have to put up your home or car as collateral for the loan.

If you’re considering a personal loan, these are some of the potential benefits you may reap. Before taking out a loan, be sure to do your research and shop around for the best interest rates and terms.

How to Apply for a Personal Loan?

Applying for a personal loan can seem like a daunting task, but it doesn’t have to be. There are a few things you can do to make the process simpler and less stressful.

First, make sure you understand the different types of loans available and which one would be best for your needs. There are secured and unsecured loans, as well as fixed-rate and variable-rate loans. Get a clear picture of what you’re looking for before you start shopping around. Next, compare rates and terms from a variety of lenders. Don’t just go with the first offer you get – shop around and compare to make sure you’re getting the best deal.

Finally, make sure you read and understand the loan agreement before you sign anything. This is one of the most important steps in the process, as it will protect you from any hidden fees or unfair terms. By following these simple steps, you can make sure that applying for a personal loan is a smooth and stress-free process.